Have you heard of the 50 30 20 rule for home budgeting? Not many have but it could be the one thing to help you create and stick to a budget that you can use to get a handle on your expenses and your savings.

Monthly budgets, no one likes them, and few people use them. Let’s face it, we don’t really like the thought of tracking down where our money goes each month and finding ways to cut down. It is against our nature to cut back because we know the cutting will be things we like to do, like eating out or hobbies.

Yes, it will be somewhat of a tedious process to track your monthly expenditures, but not as hard as you might think. Looking at monthly mortgage, rent, insurance, and credit card statements will give you the majority of what you need.

Let’s dive in and look at the 50 30 20 rule budget plan and see if it may be right for you.

What is the 50 30 20 rule?

The 50 30 20 rule is a budget plan where you allocate your monthly take home (after tax) income to the following areas:

50% to Needs

Needs are what you need for survival, or at least comfortable survival. They are a usually a constant that you pay for every month. They include things like:

- Mortgage + property taxes, or rent

- Groceries

- Insurance

- Utilities, such as electricity, water, and sewer service

- Car payments and gas, or public transportation costs

- Phone and Internet costs

30% to Wants

Wants are what you desire but don’t really need to survive. They include:

- Eating out (this includes the morning coffee shop on the way to work)

- Hobbies

- Vacations

- Cable TV or streaming services like Netflix, Hulu, Disney+, etc.

20% to Saving for Financial Goals

This area is all your long and short-term financial goals:

- Emergency fund

- A new boat or bigger home

- First home down payment

- Kid’s education

- Paying off debt

- Retirement

As you can see, the 50 30 20 rule is a simple guideline that shows you how to allocate your income so that you are putting money away for the future. Nothing says that you can’t increase the percentage of the saving for financial goals at some point. Maybe after a year you get used to the 50 30 20 budget and decide to make it a 50 25 25 budget. That’s great. Go for it! The more you can put away for your financial goals, the better.

First you must track where your money goes

One thing to note here is that the 50 30 20 rule is actually part two of the process. You will first need to sit down and track everything you spend your money on before you can apply this rule. The above breakdown of each of the 50 30 20 areas will help you find most of your monthly expenditures, then account for anything not on this list and put it in the correct area.

This is where great enlightenment comes. After tracking everything you spend money on, you will KNOW where it all goes and have an idea of what you can do to improve it.

How to Allocate the 50 30 20 rule

OK, so here comes the fun part(?), putting it all together.

Add up all your monthly take home income. If you get income from anything else other than your job(s), add them all up. If you pay into a 401k or some other employer retirement plan, add in what you pay into it each month. This is your total monthly income.

Multiply that number by .50, that is what goes toward your NEEDS area. Multiply your total income by .30, that is what goes toward your WANTS area. Multiply your total income by .20, that is what goes toward your FINANCIAL GOALS area. All three of those numbers should add up to your total monthly income number.

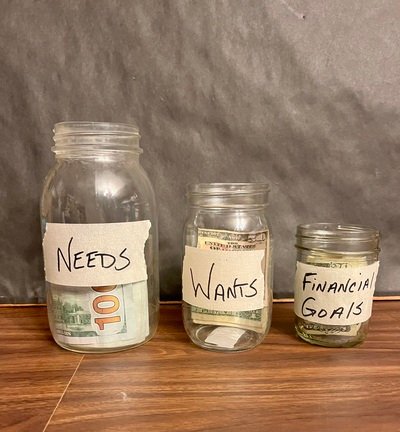

Think of it as taking your monthly income and putting it into three different jars labeled Needs, Wants, and Financial Goals.

Let’s look at an example. For the simplicity of math, let’s say your total monthly take home income is $1,000. Your breakdown would be:

50% Needs = $500. This is what is allocated for all your monthly Needs.

30% Wants = $300. This is what is allocated for all your monthly Wants.

20% Financial Goals = $200. This is what is allocated for all your monthly Financial Goals savings.

Time to compare

Do you remember me asking you to actually track where your money went out to for the month? Now is the time to put those expenditures into the correct areas of Needs, Wants, and Financial Goals to see where you actually stand. Do this and see how close you are.

Don’t worry if your Wants area exceeds the 30% and your Financial Goals savings are short of 20%. The point of doing all this is for you to see where you actually are in terms of a budget and what you need to do to get yourself within the 50 30 20 rule.

It’s never too late to get your money in order and start managing finances to get where you want to be. You may come to find out that you are spending $200 a month on lunches. How about that $7 coffee at Starbucks every morning? No one says you must cut out all the good stuff, but you can cut back by substituting alternatives a couple times a week.

The 50 30 20 rule

As it stands, the 50 30 20 rule isn’t perfect and may or may not work for you. If you are struggling to make ends meet, the 20% savings for financial goals may be impossible right now. That’s OK. Maybe you need to initially rearrange the numbers to 60 30 10 or something else for now until you get things in order.

The point to all of this is for you to know where your money is going each month and see if you can put some money away toward a better life.

The 50 30 20 rule is meant to be a simple way to divvy up where your money should be going each month. It is by no means the only budget plan option. There are many more ways to set up and manage a budget. I plan to cover more budget options in further articles. Here is a very nice inexpensive Budget Planner that you can use to layout and track everything in one place.

Thank you for reading and please check out my other managing finances articles on How to Save Money Fast – Saving Money Tips and 11 Options for the Best Affordable Alternatives to Cable TV.

0 Comments